Latin America Defies the EM VC Slowdown - Can the momentum continue?

- Aug 20, 2025

- 5 min read

Written by: Shirley Mabasa | Research Contributor, London Venture Capital Network

Over the past two years, venture capital has faced a global reckoning. Rising interest rates, tightening liquidity, and a dramatic correction in tech valuations have slowed fundraising and deal-making across developed and emerging markets alike. From Africa to Southeast Asia, the capital inflows that surged during the pandemic era have softened, with investors retrenching towards safer assets. Yet against this backdrop, Latin America stands out.

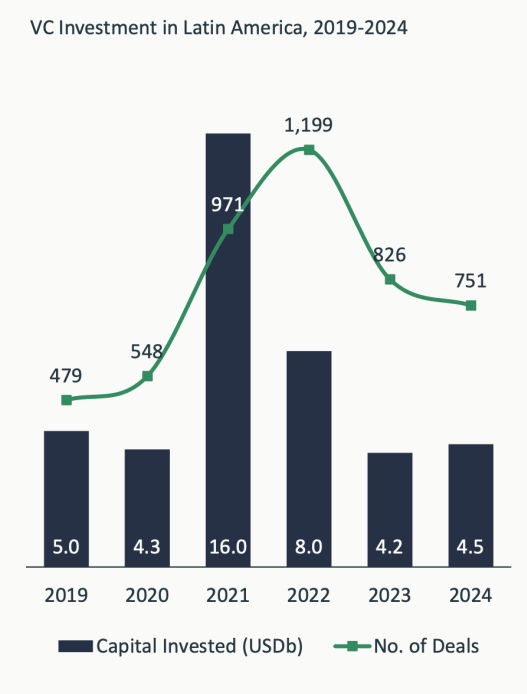

After a steep correction (similar to other markets) following the record-breaking highs of 2021, venture capital in Latin America showed signs of recovery in 2024. According to the data (see figure 1 below), capital invested rebounded modestly to $4.5 billion across 751 deals, up from $4.2 billion and 826 deals in 2023. While still well below the 2021 peak of $16 billion and 1,199 deals, the latest figures indicated that the ecosystem was stabilising after two years of contraction.

Figure 1: VC Investment in Latin America, 2019-2024

Source: LAVCA

The resilience is notable given the global venture slowdown. Latin America’s fundamentals such as large underbanked populations, rapid digital adoption, and a deepening base of local funds continue to support deal flow. Early indications also suggested that the recovery seen in 2024 continued in early 2025, signalling that the region may be entering a more sustainable growth phase, unlike its peers. This resilience stands out even more clearly when compared with other emerging markets, where funding has continued to contract and ecosystems remain under pressure.

How Latin America Stacks Up Against other Emerging Markets

Southeast Asia

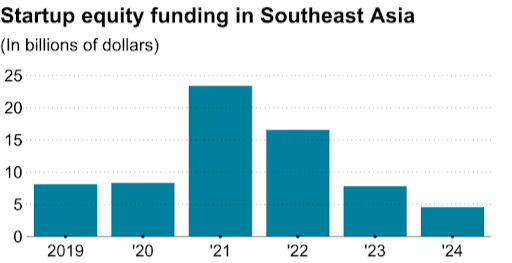

The contrast with Southeast Asia could not be sharper. According to Nikkei Asia, Southeast Asia’s startup funding fell for a third straight year in 2024, dropping 42% year-on-year to $4.56 billion, just 20% of the region’s 2021 peak (figure 2). Deal volumes also slid to around 633 transactions, and late-stage rounds collapsed as investors turned more risk-averse. Other trackers such as Tracxn place the decline even steeper, noting that tech funding plunged 59% year-on-year to $2.84 billion, with late-stage deals down nearly 77%.

Figure 2: Startup equity funding (US$bn) in Southeast Asia

Source: DealStreetAsia

Africa

Africa’s venture ecosystem has undergone a remarkable transformation over the past decade. Between 2015 and 2022, deal value grew at a compound annual growth rate of 16%, with funding surging from just $0.4 billion in 2015 to a record $6.6 billion in 2022. This period was driven by a wave of fintech innovation, rising digital adoption, and increased participation from global investors.

Figure 3: Venture Deal Value (US$bn) in Africa, By Year

Source: AVCA

However, the post-2022 environment has brought a sharp correction. Venture capital flows fell to $4.6 billion in 2023 and further to $3.6 billion in 2024. The pullback mirrors the broader global slowdown in VC activity, though in Africa it has been compounded by currency devaluations, political risk in certain markets, and tighter exit prospects.

Notably, equity investment has slowed more dramatically than in Latin America, and an increasing share of capital now comes in the form of venture debt ($1 billion in 2024, nearly one-third of total deal value). This reflects both the pressure on equity markets and the search for alternative financing structures in a riskier macro environment.

The question, then, is what explains Latin America’s relative resilience?

1. Country Focus: The Three Engines driving Latin American VC

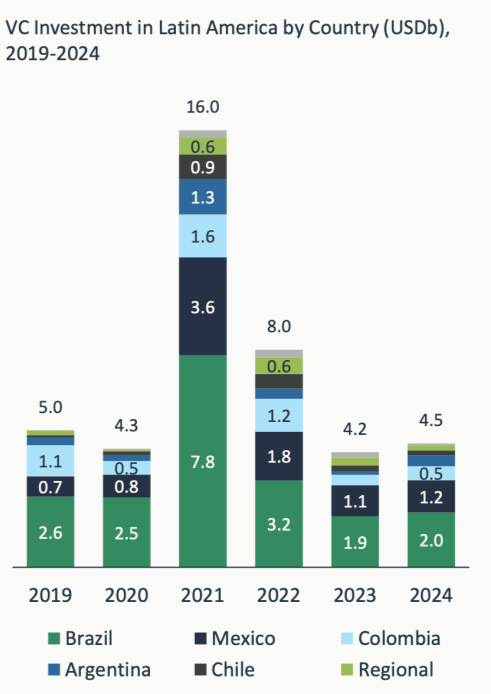

Figure 4: VC Investment by Country

Source: LAVCA

Brazil remains the anchor of Latin American VC, consistently accounting for the largest share of funding. Even after the post-2021 correction, the country attracted close to $2 billion in 2024. Its dominance is underpinned by structural factors: a vast underbanked population, rapid adoption of digital services, and a maturing investor base led by funds such as Kaszek and Monashees. Standout companies like Nubank, which listed on the NYSE in 2021, have set the tone for the region, while Creditas (consumer and asset-backed lending), QuintoAndar (proptech), and Wildlife Studios (gaming) continue to demonstrate Brazil’s ability to produce global-scale startups.

Mexico has consolidated its position as the region’s second growth engine. Funding peaked in 2021 at $3.6 billion before stabilising around $1.2 billion in 2024. Its proximity to the US and the tailwinds of nearshoring have made it particularly attractive to international investors. Notable contributors include Kavak, the used-car marketplace and Mexico’s first unicorn; Clip, the payments platform that secured a major round in 2024; and Jüsto, the online grocer expanding across the region.

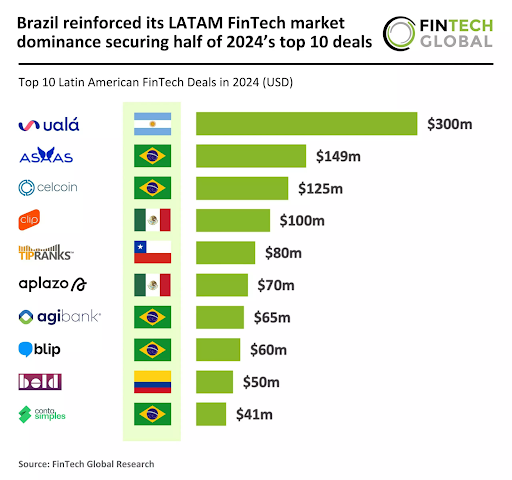

Argentina, despite persistent macroeconomic volatility, continues to produce breakout companies. Much of the country’s venture inflows are driven by fintech, with Ualá standing out. Its $300 million round in 2024 alone accounted for the bulk of Argentina’s funding, highlighting the country’s ability to attract capital even amid economic turbulence. The long-standing success of Mercado Libre (South America’s leading e-commerce platform) also anchors investor confidence in Argentina’s tech ecosystem.

2. Sector Dynamics: Key Trends Driving Resilience

From a sectoral perspective, the region benefits from a combination of structural demand, ecosystem maturity, and global investor confidence that continues to sustain venture activity even in leaner years. In particular, the three trends underpinning the resilience seen in the LatAm VC ecosystem include:

Trend 1: Financial Inclusion and the Fintech Engine

Latin America remains one of the most underbanked regions in the world, with tens of millions of consumers and small businesses lacking affordable access to credit, savings, and insurance. This unmet need has underpinned the dominance of fintech, which still accounts for the largest share of venture flows (figure 5).

Figure 5: Top 10 Latin American Fintech Deals in 2024 (USD$m)

Source: Fintech Global

Trend 2: Digital Adoption Beyond the Pandemic

The pandemic dramatically accelerated digital behaviours across e-commerce, payments, education, and healthcare. Unlike in other markets, many of these shifts have endured, creating sticky demand for digital-first solutions. Companies like Rappi in Colombia and Jüsto in Mexico exemplify how consumer habits have permanently shifted online, sustaining venture interest even after the COVID surge.

Trend 3: Proven Unicorns and Exit Pathways

Latin America has already produced a roster of unicorns and success stories (from Nubank’s IPO to Kavak’s regional expansion) that demonstrate exit potential is not a theoretical possibility but a realised outcome.

Additionally, unlike other emerging markets, Latin America benefits from its geographic proximity to North America. US investors, in particular, view the region as a natural extension market (this is further reinforced by the ongoing nearshoring trend that is driving supply chains and investment closer to the US). This dynamic has likely helped sustain flows even as global LPs have retrenched elsewhere.

Forecasts and 2025 Performance: A Fragile Start

The first quarter of 2025 has tested Latin America’s venture rebound. Startups raised $881 million across 63 deals, slightly below the average of about $1 billion deployed per quarter over the past two and a half years. This keeps activity broadly steady but marks one of the weakest quarters since the recovery began, pausing the upward trend that carried through 2024.

Figure 6: VC Flows in Latin America (USD$bn), By Quarter (2020-2025)

Source: LAVCA, Serebrisky

Macroeconomic conditions offer cautious support. Regional growth is expected to average 2.7% in 2025, with Argentina near 5%, Colombia at 2.4% and Chile at 2.1%. Inflation is easing and several central banks are beginning to lower rates, which could gradually improve funding conditions.

Still, the muted start highlights how fragile momentum remains. Global rates, investor caution and limited late-stage capital continue to weigh on activity. The key question is whether Q1 reflects a temporary pause or the start of a plateau. The coming quarters will show if Latin America’s venture ecosystem can move beyond recovery and sustain the momentum that has set it apart from other emerging markets.

Encouragingly, Q2 has already shown brighter signs. Mexico overtook Brazil as the leading VC destination for the first time since 2012, raising over $430 million on the back of large rounds for Klar and Kavak. This signals that capital remains available for strong performers, and that regional leadership within Latin America is becoming more dynamic.

Read more insights at londonvcnetwork.com/publications